Week 51, 2024

-

-

Overview

-

- MS shareholders reject Bitcoin

- Google reveals quantum breakthrough

- Google releases Gemini 2.0

- Apple adds ChatGPT to Siri

- Apple develops AI server chips

- China probes Nvidia

- GM exits robotaxi business

- Google, Samsung join XR forces

- OpenAI launches Sora publicly

- Meta sides with Musk against OpenAI

-

-

Key Developments

-

- Big tech remains wary of Bitcoin. Microsoft shareholders strongly rejected a proposal to invest in Bitcoin, with just 0.55% supporting it. Amazon will vote on a similar measure next April. Despite Bitcoin's rise, major corporations still view it as too risky for their balance sheets.

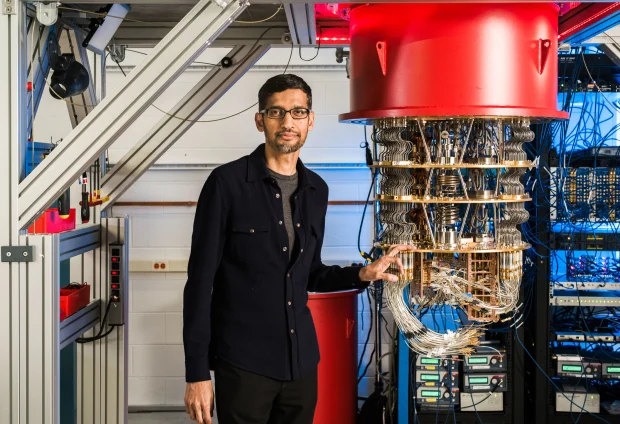

- Google achieves a breakthrough in quantum computing. The new 'Willow' chip reduces error rates as qubit count increases, drawing praise from Musk and Altman and boosting Alphabet's stock. However, its 105 qubits fall far short of the millions needed for industrial applications, with quantum threats to Bitcoin still 10-20 years out.

- Google makes its big move into AI agents. The company's Gemini 2.0 update brings faster responses and better multimodal capabilities, powering a new lineup of specialized AI tools - from Astra, a universal AI assistant, to Mariner for browser automation and Jules for coding. By announcing plans to put Astra in smart glasses, Google is betting that AI agents will soon become part of everyday life.

- Apple finally brings ChatGPT to Siri, just six months after its WWDC preview. Running on OpenAI's latest GPT-4o model, the upgraded Siri now handles complex queries and offers writing, summarizing, editing, and image generation - all without switching apps. In a classic Apple move, users can control exactly what data gets shared with OpenAI, showing the company hasn't forgotten its privacy-first stance.

- Apple expands its chip ambitions beyond iPhones and Macs. The company is now developing custom AI server chips to handle complex queries in the cloud. Working with Broadcom and using TSMC's 3nm process, Apple aims to start production by 2026. The tech giant isn't stopping there - it's also bringing Bluetooth and WiFi chips in-house next year, showing its determination to control every key component in its ecosystem.

- China opens antitrust probe into Nvidia, but timing tells a bigger story. The investigation centers on alleged violations from Nvidia's $6.9B Mellanox acquisition in 2020, but it comes just a week after new U.S. chip export controls - suggesting this is China's retaliation and a warning shot to a potential Trump administration. The move shows how tech companies are increasingly caught in the crossfire of U.S.-China tensions.

- GM throws in the towel on robotaxis. The company's cutting off investment in its self-driving unit Cruise after burning through $10 billion, with operations already on pause since last year's pedestrian accident. The move hands Google's Waymo the keys to the U.S. robotaxi market, while leaving Microsoft to swallow an $800 million loss on its Cruise investment - showing just how tough it is to make self-driving cars a reality.

- Google and Samsung join forces to take on XR. The partnership plays to each company's strengths - Google's developing the operating system with AndroidXR, while Samsung's upcoming headset 'Moohan' will be its first showcase device. This tag-team approach could shake up the XR market currently dominated by Meta and Apple, making 2025's headset battle a lot more interesting.

- OpenAI's Sora launch turns chaotic as overwhelming demand crashes the service for three straight days. Despite being a paid feature for ChatGPT Plus and Pro subscribers, the video AI remains inaccessible while CEO Sam Altman admits they "significantly underestimated" demand - with no timeline for fixes or compensation offered. The rocky rollout raises questions about OpenAI's infrastructure planning and customer service approach, particularly for a paid product.

- OpenAI fights back against Musk with revealing emails. The messages show Musk actually pushed for a for-profit structure and wanted to be CEO - the opposite of his lawsuit claims. After being denied control, he left in 2018 and started rival xAI. Now Meta's joining Musk's side against OpenAI's profit plans, despite Zuckerberg and Musk's famous rivalry - showing how the AI race is creating unexpected alliances.

-

-

Other notable updates

-

AI — Tech

Google debuts Gemini 2.0.

Apple adds ChatGPT to Siri.

xAI releases free Grok 2.

OpenAI launches Sora video AI.

OpenAI launches Canvas for collaboration.

OpenAI adds Projects feature.

Amazon opens AGI research lab.

Microsoft reveals math AI 'Pi4'.

Reddit adds AI search.

Meta launches Motivo for avatars.

Meta launches VideoSeal for watermarks.

-

AI — Business

Meta opposes OpenAI's for-profit switch.

OpenAI says "Musk wanted for-profit first".

MS reveals 2025 AI trends.

-

Chips / Infrastructure

Google debuts next-gen quantum chip.

Apple developing AI chips with Broadcom.

Broadcom stock soars on AI profits.

Amazon to focus on training chips.

China probes Nvidia after U.S. chip curbs.

TSMC Nov sales jump 34% YoY.

Intel eyes Apple's Srouji for CEO.

-

Devices / Hardware

Google unveils AndroidXR OS.

Samsung plans XR headset with AndroidXR.

Apple working on new Magic Mouse.

Apple shifts AirPods production to India.

Apple Watch gets satellite, health upgrades.

-

Content / Entertainment

YouTube launches auto-dubbing feature.

-

Social Media

Bluesky teases paid subscriptions.

AUS to charge social media for news usage.

-

E-Commerce

Amazon considers Bitcoin.

Amazon selling Hyundai cars online.

Amazon launches 15-minute delivery in India.

-

EV / Autonomous

GM exits robotaxi business.

Tesla Supercharger becomes US standard.

Tesla plans budget Model Q.

Tesla reboots PR team.

Hyundai adds Google Maps.

-

Energy / Environment

MS designs 'zero-water' data centers

-

Space

SpaceX valued at $350B, surpassing TikTok.

-

Etc

Pentagon launches AI cell.

-