Week 50, 2024

-

-

Overview

-

- AWS hosts re:Invent 2024.

- xAI opens Grok to all X users.

- OpenAI diversifies revenue streams.

- Meta, xAI compete in data center scale.

- DeepMind, World Labs launch 3D AI tools.

- Perplexity's AI shopping falls short.

- Spotify's AI Wrapped receives backlash.

- Intel CEO Gelsinger steps down.

- Trump names crypto-AI advisor.

- Uber, Baidu launch global robotaxis.

-

-

Key Developments

-

- AWS made major waves at their re:Invent 2024 conference by clearly staking out their position in the AI race. While CEO Andy Jassy unveiled their new foundation model 'Nova' with six different versions, the industry's reaction was notably subdued. This timing is interesting - as the technical arms race between AI models starts to plateau, AWS is taking a broader view, doubling down on what they do best: building robust infrastructure platforms through Bedrock and SageMaker to support a thriving AI ecosystem.

Their AI chip development fits perfectly into this strategy. They've launched the Trainium2 and have already teased an even more powerful Trainium3 in the pipeline. Perhaps the biggest surprise of the event was seeing Apple show up as an AWS chip customer - something that rarely happens and suggests AWS's AI infrastructure play is already gaining serious traction.

- X appears to be transforming into Musk's AI testing ground. His AI company xAI, which raised an impressive $6 billion from 97 investors, has now made its AI chatbot 'Grok' available to all X users. Adding to this, they've launched an image generator called 'Aurora,' allowing X users to create and instantly post surreal images on the platform. Given X's recent user exodus amid controversies over bias, there's growing concern that the platform might be losing its core social media functionality and instead becoming merely a showcase for xAI's technology demonstrations.

- OpenAI is accelerating its monetization efforts under financial pressure. Beyond launching the $200/month ChatGPT Pro and enterprise o1 service, they're exploring advertising and have hired their first CMO with aims to reach 1 billion users next year.

The company's partnership with defense contractor Anduril for drone defense AI has sparked employee pushback, despite promises to avoid offensive weapons. Most notably, OpenAI is considering removing its AGI technology-sharing restriction with Microsoft to secure more funding. With projected losses of $5 billion this year, this signals a shift from their idealistic origins toward more pragmatic business operations.

- AI infrastructure competition is heating up. Meta has started building its largest-ever AI data center, but xAI's plans are even bolder - they're aiming to expand their Colossus supercomputer tenfold with a planned deployment of 1 million GPUs. This aggressive scaling by Musk's company, despite being a late entrant, shows his determination to stay competitive in the AI race.

- The 3D generative AI race is gaining momentum. Google DeepMind has unveiled Genie 2, while World Labs, led by Fei-Fei Li, demonstrated technology that can create interactive 3D spaces from a single photo. This evolution from simple image generation to interactive 3D environments could revolutionize metaverse and gaming industries by dramatically reducing content creation costs and time.

- AI shopping assistants still face significant hurdles. Early users of Perplexity's AI shopping feature report frustrating experiences - purchases taking hours to complete or getting canceled entirely. The main issue is that these agents place orders independently without direct commerce integration, meaning they can't access real-time inventory data.

Meanwhile, AWS has taken a simpler approach with their 'Buy with AWS' button, enabling one-click purchases of third-party software for AWS account holders. While less magical than AI promises, this straightforward solution seems more practical for now - though Amazon's unique position with expertise in commerce, AI, and digital payments suggests interesting possibilities ahead.

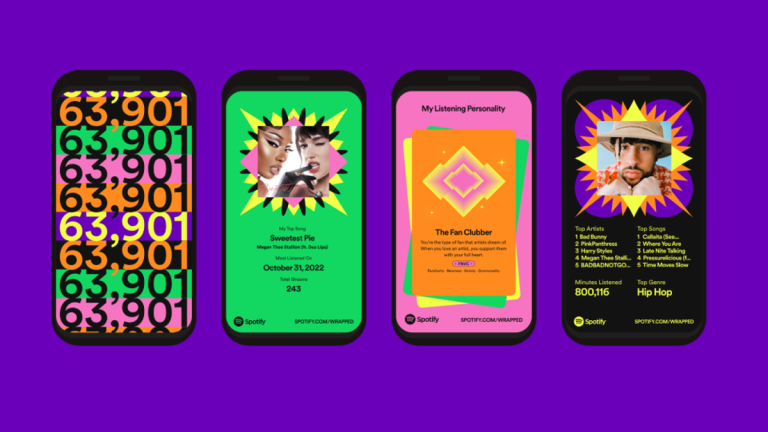

- Spotify's attempt to enhance their year-end Wrapped service with AI backfired. Their new AI-powered personalized podcast, which analyzed users' year of listening habits DJ-style, received a lukewarm response. Critics say replacing Spotify's signature creative data storytelling (like music personality analysis and city matching) with the AI podcast diminished the service's charm.

Similarly, Airbnb's announcement of major updates for next year has been met with skeptical "probably just more AI" reactions. These cases suggest that AI integration isn't always the best solution for beloved user experiences.

- Intel CEO Pat Gelsinger has been effectively ousted amid continued poor performance. His vision to rival TSMC in foundry services while maintaining chip design fell short, with insufficient time to reverse the company's long-term structural decline. The board's patience apparently ran out as stock prices fell, despite this being a known long-term, capital-intensive strategy. Gelsinger's departure signals a potential strategic shift for Intel, raising questions about the future of their foundry business.

- Trump's recent nominations reflect Musk's growing influence: Jared Isaacman, SpaceX investor and first civilian spacewalker, for NASA administrator, and PayPal Mafia's David Sacks, a deregulation advocate, as AI and crypto chief advisor. These choices suggest a favorable environment for SpaceX and xAI, prompting even former rivals to cozy up to Musk.

- Self-driving services are rapidly expanding globally. Waymo plans to enter Miami next year, strengthening its U.S. presence, while Baidu begins its international expansion with robotaxi testing in Hong Kong. Uber has partnered with Chinese autonomous driving company WeRide to launch robotaxis in Abu Dhabi - their first international self-driving service. Meanwhile, Uber Shuttle, developed by Uber's India division, has completed 30 million rides across 20 global cities, demonstrating the potential for locally-adapted mobility services.

-

-

Other notable updates

-

AI

Meta releases cost-efficient Llama 3.3.

Google launches Veo and Imagen 3 on Vertex AI.

Google unveils PaliGemma 2 that can detect emotion.

Meta develops MetaMate AI productivity suite.

ByteDance leads China's AI race.

-

Chips / Infrastructure

Nvidia, TSMC discuss U.S. Blackwell production.

-

Devices / Hardware

BYD makes 30% of all iPads.

Meta moves some MR headset production to Vietnam.

-

Content / Entertainment

Apple, Sony discuss VR gaming on Vision Pro.

Netflix hits 10M users in Japan.

-

Social Media

TikTok ban ruled constitutional.

Bluesky doesn't rule out ads.

Threads shows individual post metrics.

-

EV / Autonomous

Tesla robotaxi uses 50% fewer parts than Model 3.

Tesla API pricing faces criticism.

-

Energy / Environment

Meta seeking additional nuclear power.

-

Commerce

Walmart completes Vizio acquisition.

-

Etc

Court rejects Musk's package again.

Bitcoin hits $100K mark.

-