Week 42, 2024

Overview

- Microsoft Unveils Blackwell Server

- Nvidia's Blackwell Bonanza

- AMD Challenges Nvidia's AI Reign

- TSMC's AI-Fueled Profit Surge

- Tesla's Robotaxi Reveal Flops

- Musk's Trump Gambit

- OpenAI's Global Expansion

- OpenAI's Long Road to Profitability

- Google's AI Scientists Win Nobel

- Google Faces Breakup Threat

Highlights

1

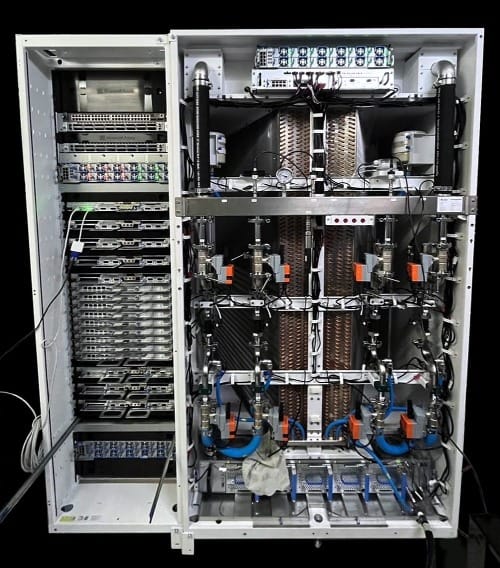

Microsoft Unveils Blackwell Server

Azure became the first cloud provider to run Blackwell-based servers.

- Nvidia sent first Blackwell AI chip supply to Microsoft and OpenAI.

Microsoft showcased custom-built GB200 server.

- GB200 combines 72 Blackwell GPUs with 36 Grace CPUs.

- New setup offers up to 30x faster inference for LLM workloads.

- It looks like this:

OpenAI received DGX B200 engineering sample.

- New server equipped with 8 Blackwell GPUs.

- Offers 3x training and 15x inference performance boost over predecessor.

2

Nvidia's Blackwell Bonanza

Nvidia sells out entire year's supply of Blackwell GPUs.

- Existing customers like Microsoft, Google, Meta, and Amazon secure early orders.

- New orders will be delivered late October next year.

- Nvidia's AI processor market share expected to grow further next year.

Morgan Stanley: "We're at the very early stages when we say demand is strong."

3

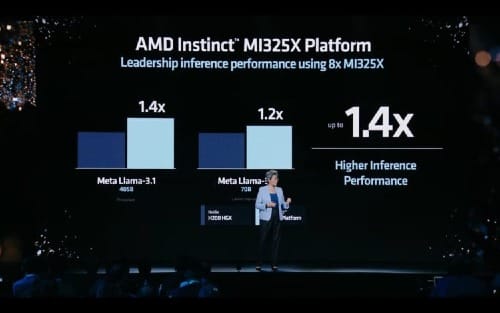

AMD Challenges Nvidia's AI Reign

AMD launched MI325X as competitor to Nvidia's Blackwell.

- However, analysts say performance gap is still significant.

- Targets production early next year using TSMC's 3nm process.

- AMD also revealed roadmap for next two years' products.

Lisa Su: "Will offer better performance than Nvidia."

Berstein: "Improved, but no match for Blackwell."

4

TSMC's AI-Fueled Profit Surge

TSMC achieves record revenue due to rising AI chip demand.

- Q3 revenue: $23.6 billion, up 36.5% YoY.

- Q3 net profit expected to increase by 40%.

- Detailed earnings report scheduled for 17th.

TSMC flexes pricing power.

- Lack of strong competitors allows TSMC to maximize profit margins.

- 2nm chip prices set above $30,000 per wafer, 1.5-2x higher than 3nm.

- Market cap nearing $1 trillion, currently at $970.5 billion.

5

Tesla's Robotaxi Reveal Flops

Tesla stock plunges 8.8% following disappointing robotaxi announcement.

- Vague launch timeline and lack of concrete details draw criticism.

- No information provided on safety data or revenue model.

Elon Musk: "Production maybe in 2026, let's say before 2027."

Bernstein: "Surprisingly lacking in details."

Some 'Cybercab' facts:

- 2-seater without steering wheel or pedals.

- Vehicle priced under $30,000.

- Fare set at one-fifth of city bus rates.

- Multi-passenger 'Robovan' also revealed.

6

Musk's Trump Gambit

Elon Musk shifts further right, backing Trump's election bid.

- @America X account seized for campaign use.

- Legal cash incentives offered to swing state voters.

- $47 reward for introducing conservative voters.

Tesla faces multiple setbacks amid Musk's political moves.

- Stock plummets after underwhelming robotaxi reveal.

- Wall Street mocks "toothless taxi" presentation.

- Key robotaxi executive departs for Waymo.

7

OpenAI's Global Expansion

OpenAI adds offices in 5 new cities globally.

- New locations: New York, Seattle, Paris, Brussels, Singapore.

- New York and Singapore offices to open by year-end.

- Total of 9 offices across 7 countries, including existing locations.

- Oliver Jay, ex-Asana and Dropbox, appointed to lead global expansion.

Singapore emphasized as key expansion target.

- Singapore noted as global AI hub with active Big Tech collaborations.

OpenAI: "Singapore has one of the highest ChatGPT usage rates per capita globally."

8

OpenAI's Long Road to Profitability

OpenAI projected to operate at a loss until 2029.

- Revenue growing annually, but costs rising significantly.

- $5 billion loss expected this year alone.

- Cumulative losses may reach $44 billion by 2028.

New York Times reported planned subscription fee increases.

- $2 price hike by year-end, aiming for $44 within 5 years.

9

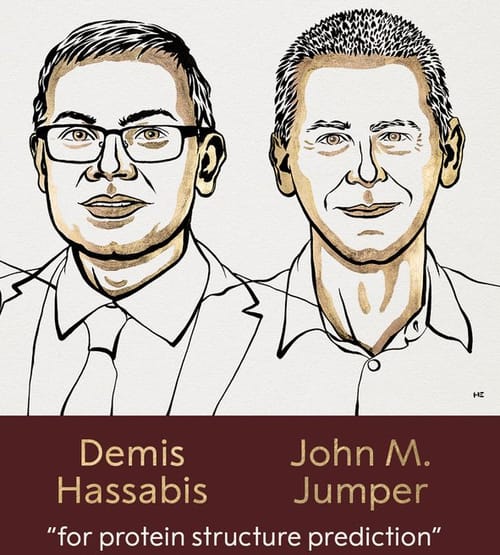

Google's AI Scientists Win Nobel

Geoffrey Hinton won 2024 Nobel Prize in Physics.

- Former Google VP.

- Pioneered neural networks enabling modern machine learning breakthroughs

Demis Hassabis and John Jumper shared 2024 Nobel Prize in Chemistry.

- Hassabis: DeepMind CEO

- Jumper: DeepMind Senior Research Scientist.

- Honored for AlphaFold2, predicting structures of 200 million proteins.

Awards come 10 years after Google's DeepMind acquisition.

- In 2019, Alphabet wrote off $1.49 billion in debt that DeepMind had accumulated over recent years.

- In 2020, Google stated that "Biological breakthroughs are built on DeepMind's deficit."

- Despite substantial losses, Google continued to allow high personnel costs to retain top researchers.

Unusual win breaking traditions.

- Nobel typically focuses on pure sciences over interdisciplinary work.

10

Google Faces Breakup Threat

U.S. DOJ announces consideration of Google breakup.

- Proposal to divest parts of Google's business submitted to court.

- Google immediately opposes, calling the move "radical."

- Specific sanctions to be decided by August next year.

Stock price minimally affected; investors skeptical of feasibility.

- Reminiscent of failed 2000 Microsoft breakup attempt.

- Google's appeal could extend final decision for years.

- Jim Cramer, CNBC: "Government investigation is misguided, futile, and frankly, even un-American"

Other

AI

- OpenAI announces content deal with Hearst.

- Sierra, founded by OpenAI chair, seeks $4B valuation.

- Intel·InflectionAI launch enterprise AI solutions.

- Meta AI expanding to 21 more countries.

- Microsoft releases medical AI tools suite.

Chips

- TSMC plans European expansion, likely in Czech Republic.

- TSMC to expand Kaohsiung facility to five fabs.

- Intel may cut Gaudi3 shipment by 30%.

Device/Hardware

- Apple plans $2000 Vision headset next year

- Apple's Vision Pro chief Dan Riccio retires.

- iPhone to finally support call recording.

- Apple opens major research hub in Shenzhen.

- Huawei's China smartphone sales in August beat Apple.

- Huawei launches 'Harmony Next' OS, dropping Android app support.

Content/Entertainment

- YouTube Shorts extends to 3 minutes, matching TikTok's 2020 move.

- TikTok lays off hundreds of content moderators, expands AI detection.

- TikTok launches AI-powered ad system 'SmartPlus'.

- TikTok faces lawsuits in 13 US states over teen safety.

Commerce

- Amazon unveils next-gen warehouse.

- Cuts costs 25% with 10x more robots.

- Amazon enters general air cargo market.

- Currently operates 100+ planes, 250 daily flights.

- Amazon extends same-day medication delivery to 20 cities.

- Amazon tests drone prescription delivery in Texas.

EV/Autonomous Vehicles

- Tesla car fire in France kills four people.

- Apple officially cancels autonomous vehicle permit.

Space

- SpaceX successfully catches returning Starship rocket.

- Superheavy booster caught mid-air by 'chopstick arms'.

Policy/Regulation

- US court mandates Google to open up its App Store.

- Google wants the ruling put on hold.