Week 41, 2024

Highlights

1

OpenAI secures record-breaking $6.6 billion investment

- Valuation soars to $157 billion.

- Now 3rd largest private company globally, behind ByteDance and SpaceX

- Secured additional $4 billion credit line.

- Total liquidity reaches $10 billion.

Deal terms:

- OpenAI must convert to for-profit within 2 years.

- Investors barred from backing/collaborating with competitors (xAI, SSI, Anthropic, Perplexity, Glean).

2

OpenAI opens first New York office amid rapid expansion

- Employee count surges from 770 to 1,700 in a year.

- Company recently leased entire 6-floor building in San Francisco.

- New York office opened in Soho's Puck Building.

- Building owned by Trump's in-laws.

- Shared location with Thrive Capital, lead investor in recent funding.

- Thrive Capital founder is Trump's son-in-law's brother.

3

Investors flock to ex-OpenAI exec Murati

- Murati's potential new venture attracts significant investor interest

- Former OpenAI employees have history of successful startups

- Ilya Sutskever raised $1 billion in seed funding after May departure

- Anthropic and Perplexity also founded by OpenAI alumni

Speculations continue over why she left:

- The Information reported internal issues at OpenAI.

- Altman accused of dishonesty and fostering conflict.

- Safety testing allegedly rushed for faster product launches.

4

Nvidia's Jensen Huang: "Blackwell demand is insane"

- Huang's confidence dispels market concerns.

- "Everybody wants to have the most, and everybody wants to be first," says Huang.

- Stock rally pushes market cap back over $3 trillion.

Production issues resolved:

- JPMorgan: "Remains on track to ship its next-generation Blackwell GPU platform in high volume production in 4Q."

- Huang: "Everything is on track."

5

Nvidia releases powerful open-source LMM

- Unveiled NVLM-D-72B with 72 billion parameters.

- Nvidia's foray into frontier model development draws industry attention.

- Experts praise high benchmark scores.

- Performance on par with OpenAI and Google's closed models.

- Nvidia promises to release model weights and training code.

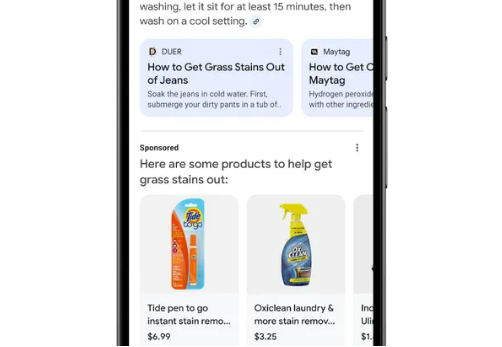

6

Google introduces ads in 'AI Overview'

- AI search results now include product and service recommendations.

- New ad format labeled under 'Sponsor' header in AI-generated content.

Move comes as Google's search ad market dominance weakens:

- U.S. market share at risk of falling below 50%.

- Amazon emerges as strong competitor in search advertising.

- TikTok and Perplexity also expanding ad offerings.

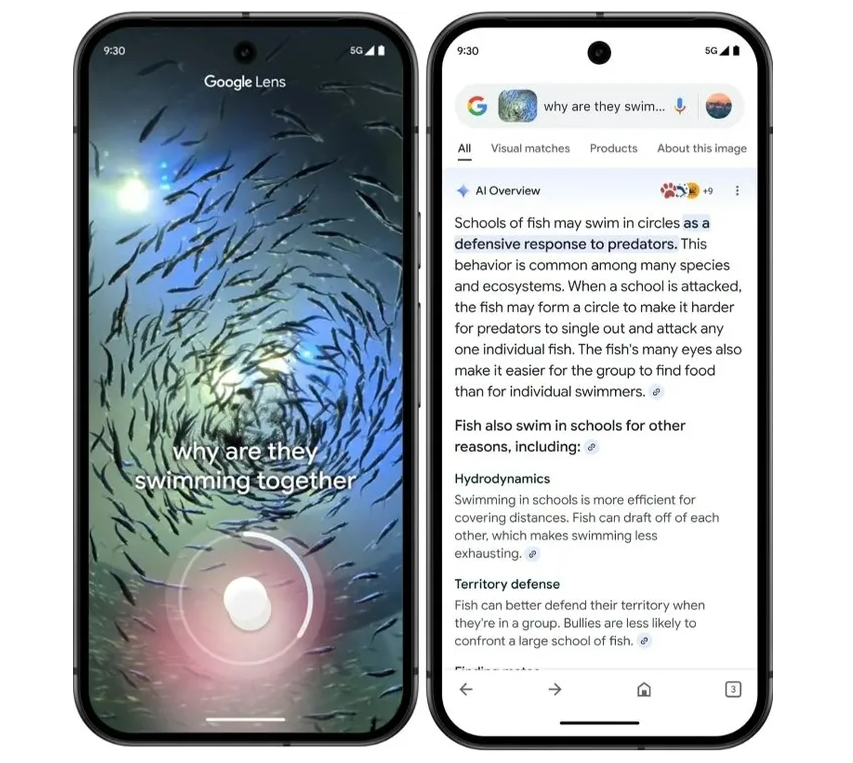

7

Google launches voice search for video content

- Google Lens update enables AI-powered video content search.

- Users can ask questions about recorded videos using voice commands.

- AI recognizes content and provides relevant search results.

- Feature not yet available in OpenAI's GPT-4o.

8

Meta unveils 'Movie Gen' AI video generator

- Creates realistic videos up to 16 seconds long with synchronized audio.

- Allows partial editing and lets users animate photos into videos.

- Will be integrated into Instagram in 2025. no separate launch planned.

- Competes with OpenAI's 'Sora' and Google's 'Veo'.

In the meanwhile:

- OpenAI's Sora lead Tim Brooks moves to Google DeepMind.

- Brooks to focus on "world model" research.

9

Microsoft pulls the plug on AR hardware

- HoloLens 2 production halted.

- HoloLens 3 development abandoned long ago.

- Numerous AR division employees laid off earlier this year.

- Despite good performance, enterprise demand lacking.

- Meta expected to dominate with 'Orion' headset.

10

Musk joins Trump rally in Pennsylvania

- Musk jumps onstage with arms raised, wearing a black MAGA cap.

- "I'm not just MAGA — I'm dark MAGA," Musk declared.

- Calls election a "must-win situation" for Trump.

- WSJ reports Musk secretly donated millions to GOP causes earlier than known.

Other

AI

- OpenAI debuts 'Canvas' for ChatGPT collaboration.

- Microsoft's Copilot gains voice and vision capabilities.

- Microsoft launches 'Bing Generative Search' beta.

- Microsoft's data center costs soar to $108.4 billion.

- Apple Intelligence set for initial release on 28th.

Chips

- AI chipmaker Cerebras files for IPO.

- Google considers nuclear power for data centers.

- ByteDance developing new AI model with Huawei chips.

Device/Hardware

- Apple to launch iPhone SE 4 with Apple Intelligence.

- Apple abandons smart ring project, focuses on Watch.

- Apple opens four new stores in India.

- Apple's Q3 results due on Halloween.

Content/Entertainment

- Netflix cancellations spiked after Reed Hastings endorsed Kamala Harris.

- Tencent explores potential Ubisoft acquisition.

Social Media

- X loses 80% of its value since Trump acquisition.

Commerce

- Amazon shuts down three more 'Amazon Go' locations.

EV/Autonomous Vehicles

- Tesla wins dismissal of 'misleading autopilot ads' lawsuit.

- Tesla loses key execs ahead of robotaxi unveiling.

- Tesla halts US sales of 'Model 3' due to tariffs.

- Waymo selects Hyundai's Ioniq 5 for robotaxi fleet.

- Toyota invests additional $500 million in Joby.

Space

- SpaceX forced to cancel another Falcon 9 rocket launch.

Policy/Regulation

- Apple sued by National Labor Relations Board over employee agreements.

- Nvidia under scrutiny for potentially concealing crypto mining revenues.

Etc

- Amazon to lay off 14,000 managers by early next year.

- Mark Zuckerberg becomes world's second-richest person, overtaking Bezos.