Week 39, 2024

Key Developments

1

Intel will spin off its foundry business, instead of selling it.

- This is part of Intel's recent restructuring plan.

- The foundry division will become an independent subsidiary.

- Intel has invested $25 billion annually in foundry for two years.

- Returns on this investment have been minimal.

- There was speculation about selling the foundry business.

- The spin-off shows Intel's commitment to continue foundry operations.

- Intel aims to attract external funding for the foundry business.

- Intel secured a chip production deal with Amazon.

- And they received an additional $3.5 billion in U.S. government subsidies.

- Yet Wall Street remains skeptical about Intel's recovery.

- The foundry market is moving towards a 'TSMC-dominated' structure.

2

Qualcomm is exploring the acquisition of Intel.

- WSJ reports Qualcomm aims to acquire all of Intel.

- This goes beyond Reuters' earlier report of Qualcomm seeking to buy parts of Intel.

- Qualcomm, the mobile chip leader, has long been interested in Intel's PC and server chip business.

- Intel's stock price has plummeted 60% this year.

- Intel's market cap is now about half of Qualcomm's, making the acquisition conceivable.

- Realistically, the deal faces significant challenges.

- Qualcomm's cash assets are only about 10% of Intel's market cap.

- Intel's workforce is more than double Qualcomm's, even after planned reductions.

- Intel's x86 license agreement with AMD could be an obstacle.

- Antitrust reviews are expected to be the biggest hurdle.

- The deal would require approval from both U.S. and Chinese authorities.

- Both companies have had acquisition deals blocked by Chinese antitrust authorities before.

- Some view Intel, once the world's top chipmaker, being an acquisition target as a "humiliation".

3

TSMC has started its first semiconductor production in the US.

- The Arizona Fab 1 has begun operations.

- It uses a 4nm process to produce A16 chips for iPhones.

- This start is at least 4 months ahead of schedule.

- Initial production yield is lower than in Taiwan factories.

- But it is expected to match Taiwan levels within months.

- Fab 2 construction has already begun.

- It is expected to start production around 2028.

- Cultural differences between Taiwanese managers and US workers are a concern.

- NYT reported on US employees quitting due to cultural clashes.

- TSMC is known for its strict corporate culture and high work intensity.

- TSMC's work intensity is notorious even in Taiwan, where long hours are common.

- How TSMC manages these cultural differences will significantly impact its US operations.

4

iPhone 16's initial sales are lower than expected.

- Pre-orders are down 13% compared to the previous model.

- Lack of AI features and hardware innovation are cited as main reasons for poor sales.

- 'Apple Intelligence' was not launched with iPhone 16 as anticipated.

- Current AI features are in beta, needing more time for full implementation.

- Hardware changes are minimal compared to the previous model.

- Demand for higher-end Pro lineup is particularly low.

- Tim Cook says, "It's just the beginning, let's wait and see."

- Apple has already started employee discounts to boost sales.

- Xiaomi has overtaken Apple as the world's second-largest smartphone maker by market share.

5

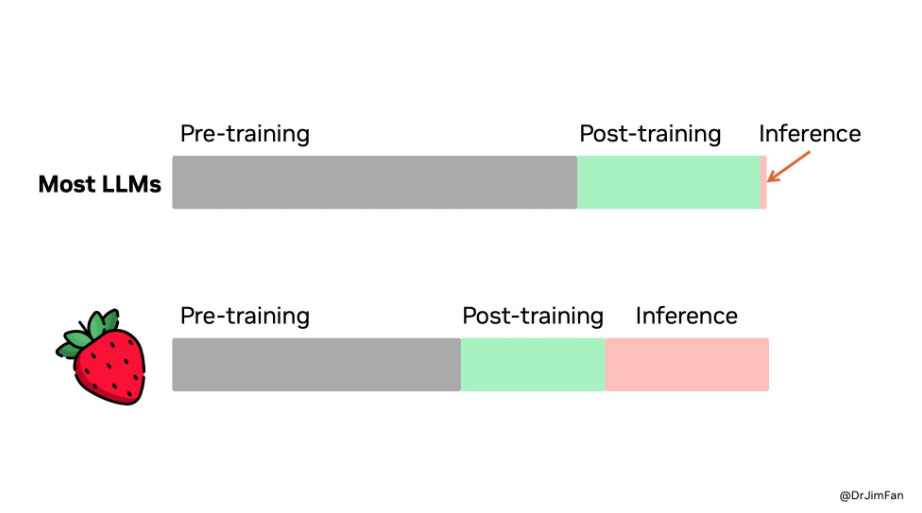

OpenAI has released 'o1', a model with enhanced reasoning abilities.

Reasoning AI

- It's pronounced as "o-one".

- The model was internally known as 'Strawberry'.

- o1 is the first in the 'Strawberry' series.

- It breaks down complex problems into steps for logical approach.

- The model focuses on science, code, math generation and debugging over language tasks.

- It showed doctoral-level abilities in physics, chemistry, and biology tasks.

- o1 achieved 83% accuracy in International Mathematical Olympiad, up from 13% of previous models.

Slow by design and expensive

- It's slower than GPT-4 due to its deep thinking process.

- o1 costs 4 times more than GPT-4 to run.

- The high cost is due to additional hidden processes and computing.

- It's designed more for scientists and developers than general users.

- GPT-4 is still more suitable for most queries.

Not quite AGI

- CEO Altman cautioned against overhyping o1.

- He emphasized o1 is not AGI, just a beginning.

- Hallucinations are significantly reduced but not completely eliminated.

6

OpenAI aims to secure $11.5 billion in new funding.

- $6.5 billion through investments and $5 billion via debt financing.

- Thrive Capital is leading the investment round.

- Tiger Global, Khosla, and Sequoia are expected to participate.

- Big tech companies like Microsoft, Apple, and Nvidia are also exploring participation.

- The investment is conditional on OpenAI converting to a for-profit company.

- A key condition is removing the profit cap for investors.

- CEO Altman hinted at a likely change in company structure next year.

- He suggested the company will move closer to a traditional for-profit model.

- If converted to a for-profit, OpenAI's market value could soar to about $150 billion.

7

Microsoft and BlackRock are creating an AI infrastructure fund.

- The fund is a response to increasing AI power demands.

- It aims to strengthen AI supply chains and clean energy sourcing.

- The fund's target size is $30 billion.

- It may expand to $100 billion with external funding.

- BlackRock's CEO Fink called it a "multi-trillion dollar long-term investment opportunity".

- Most investments will be made in the US.

- Nvidia will advise on data centers and other infrastructure.

- MGX, a UAE-backed investment firm, will participate as a GP.

- Middle Eastern oil-rich countries are increasing AI investments for economic diversification.

- The US wants this money invested domestically rather than in China.

- Saudi Arabia's PIF is discussing a $40 billion AI investment with Andreessen Horowitz.

- The Biden administration is considering allowing export of Nvidia's latest chips (H200) to Saudi Arabia.

8

Microsoft is pushing to reactivate a decommissioned nuclear plant to meet AI power demands.

- Constellation Energy plans to restart commercial operation of Three Mile Island Unit 1 in Pennsylvania by 2028.

- Three Mile Island was the site of the worst nuclear accident in US history.

- The plant was shut down in 2019 due to low economic viability.

- Constellation Energy is the largest nuclear power company in the US.

- Microsoft signed a 20-year exclusive contract for all the plant's power.

- The plant will supply power exclusively to Microsoft's data centers.

- This is Microsoft's first dedicated nuclear plant for its facilities.

- Nuclear power is attractive to tech companies for its high stability.

- Nuclear power offers 24/7 reliability needed for data centers.

- Renewable energy sources like solar and wind have fluctuating output based on weather.

- Amazon also operates a nuclear-powered cloud campus in Pennsylvania.

- OpenAI has invested in SMR developer Oklo and fusion startup Helion Energy.

- Nuclear waste disposal remains a challenge.

9

Meta is creating new "teen accounts" for users under 18.

- Meta will automatically switch Instagram accounts of users under 18 to "teen accounts".

- This is part of Meta's recently announced "Youth Safety Policy".

- Teen accounts can't view sensitive content like sexual material or self-harm.

- These accounts can only receive messages from followers or connected people.

- Parental supervision features are being enhanced.

- Parents can set daily time limits and view message recipients.

- Meta says it can track users who lie about their age.

- This move is a form of self-regulation in response to public criticism.

- There's growing concern about social media's negative impact on youth.

- Last year, 33 US states sued Meta, and the EU launched an investigation.

- Instagram's CEO expects a significant decrease in teen users.

- He believes short-term losses will lead to long-term business benefits.

- The goal is to gain parents' trust and reassure them about the platform's safety.

10

Amazon is ending remote work completely.

- The policy takes effect from January 2nd next year.

- Employees must work from the office 5 days a week, barring special circumstances.

- Currently, Amazon requires a minimum of 3 days in-office per week.

- Amazon is the first big tech company to demand 5-day office attendance.

- The announcement faced immediate backlash from employees.

- Some employees expressed intentions to quit or demanded pay raises.

- Experts suggest this could be a strategy to encourage voluntary resignations.

- Studies show strict return-to-office policies increase attrition among senior staff.

- This move may prompt other companies to mandate in-office work.

- Google, Apple, and Meta have already implemented 3-day office weeks since last year.

- A KPMG survey of 400 US CEOs found 80% expect full-time office return within 3 years.

Other

AI

- Sam Altman leaves OpenAI's safety committee, which will operate as an independent body.

- OpenAI hired a former Coursera executive to expand AI use in schools and classrooms.

- Google added an 'AI debate' podcast feature.

- Microsoft unveiled 'Copilot Pages', an AI collaboration tool.

- Oracle's stock surged 11% due to AI-related gains.

- Alibaba released a new AI model called 'Qwen 2.5'.

Chips

- Google shifts from Samsung to TSMC for production of next-gen AP.

- TSMC buys ASML's latest equipment at a discounted price.

- Nvidia launches AI Aerial to optimize wireless networks.

E-commerce

- Amazon unveiled 'Amelia', an AI assistant for sellers.

Social Media

- Meta's AI is scraping users' photos and posts.

- X moves its headquarters near Austin, Texas.

- TikTok deleted the account of Russian state media 'Sputnik'.

Content/Entertainment

- Microsoft lays off 650 employees from its Xbox division.

- Adobe provides weak guidance for the fourth quarter.

Device/Hardware

- Apple's Vision Pro sales have plummeted.

- Apple received FDA approval for hearing aid functionality in AirPods.

- Apple is pursuing a credit card partnership with JP Morgan.

- Microsoft is partnering with Anduril to develop combat goggles for the U.S. Army.

EV/Autonomous Vehicles

- Tesla has produced 100 million 4680 batteries.

- Tesla begun hiring employees in the Philippines.

- Uber expands its partnership with Waymo.

- BYD now has the world's largest R&D workforce.

Space

- SpaceX conducts the first civilian spacewalk.

Energy/Environment

- Meta buys 3.9 mln carbon credits in Latin America.

- Google signs a 128MW solar power purchase in Texas.

Policy/Regulation

- Alphabet's $1.66 billion EU antitrust fine has been overturned.

- U.S. government met with CEOs of major AI companies.

Etc

- Microsoft announces a $60 billion share buyback program and a 10% dividend increase.

- Microsoft hires a former GE CFO as its new Chief Operating Officer.